personal property tax rate richmond va

Personal Space Just for You. TAX RELIEF FOR THE ELDERLY AND DISABLED - REAL ESTATE.

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

It is an ad valorem tax meaning the tax amount is set according to the value of the property.

. Parking tickets can now be paid online. Interest is assessed as of January 1 st at a rate of 10 per year. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

The Treasurers Offices mission is to treat all of its customers courteously and fairly while maintaining exceptional professionalism and. Amelia County 804 561-2158. Click Here to Pay Parking Ticket Online.

This information pertains to tax rates for Richmond VA and surrounding Counties. Monday - Friday 8 am. Can I appeal my real estate.

Property value 100000. The personal property tax is calculated by multiplying the assessed value by the tax rate. Personal Property Tax also known as a car tax is a tax on tangible property - ie property that can be touched and moved such as a car or piece of equipment.

Manufacturers do not pay tax on purchases used for production. The property owner must be at least 65 years of age or determined to be permanently or totally disabled by December 31 st of the year preceding the year for which assistance in required. Personal Property Tax Relief.

Richmond VA 23219 Map it 804646-7000 Hours. This Commonwealth of Virginia system belongs to the Department of Taxation Virginia Tax and is intended for use by authorized persons to interact with Virginia Tax in order to submit and retrieve confidential tax information. Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill.

Richmonds average effective property tax rate is 101. Car Tax Credit -PPTR. The current rate is 350 per 100 of assessed value.

Vehicle License Tax Motorcycles. The total tax is 5 percent 4 percent state and 1 percent local A seller is subject to a sales tax on gross receipts derived from retail sales or leases of taxable tangible personal property. Make an appointment Monday - Friday or stop by at your convenience any.

It has a population of around 224000 making it the fourth-largest city in the state. As of December 31 st of the year preceding the tax year for which assistance is requested the. The personal property tax rate is determined annually by the City Council and recorded in.

Pay Your Parking Violation. Welcome to the official site of the Virginia Department of Motor Vehicles with quick access to driver and vehicle online transactions and information. Vehicle License Tax Vehicles.

35 minutes agoMeanwhile Foster is also disappointed with the emphasis on the real estate tax rate compared to personal property. The Local Tax Rates Survey is published by the Department of Taxation as a convenient reference guide to selected local tax rates. Parking Violations Online Payment.

City Code - Sec. Business Tangible Personal Property Tax Return2021 2pdf. Personal Property Registration Form An ANNUAL.

The 10 late payment penalty is applied December 6 th. Many residents called 12 On Your Side and. The county also can consider high mileage and damage beyond regular wear and tear in assigning values to vehicles.

Distributors do not pay tax on items purchased for resale. Map of Traffic Hazards. The tangible personal property tax is a tax based on the value of the property commonly referred to as an ad valorem tax.

WWBT - If you live in Chesterfield County you may have noticed a spike in personal property taxes especially when it comes to your car. Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Other collections include dog registration fees building and zoning permit fees and state taxes.

Richmond VA 23225 804 230-1212. 1000 x 120 tax rate 1200 real estate tax. Personal Property Taxes.

Real Estate Taxes. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region. A higher-valued property pays more tax than a lower-valued property.

If you have questions about personal property tax or real estate tax contact your local tax office. Tax rates differ depending on where you live. Richmond is the capital of Virginia and the place where Virginias property tax laws were established.

Box 27412 Richmond VA 23269. Call 804 646-7000 or send an email to the Department of Finance. The City Assessor determines the FMV of over 70000 real property parcels each year.

Property Value 100 1000. Other Useful Sources of Information Regarding False Alarm Fees. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established by Richmond City Council.

Team Papergov 1 year ago. June 5 and Dec. Business Tangible Personal Property Tax Return Richmond.

Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in. If you have questions about your personal property bill or would like to discuss the value. The Richmond County Treasurers Office bills and collects Real Estate and Personal Property taxes.

Map to City Hall. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Yearly median tax in Richmond City.

The median property tax in richmond city virginia is 2126 per year for a home worth the median value of 201800. Local taxes personal property taxes and real estate taxes are. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

To contact customer service regarding questions about your false alarm bill call toll-free 1-877-893-5267. It is possible that the portion of the total personal property tax on your vehicle that you have to pay may increase as the number of. Real Estate and Personal Property Taxes Online Payment.

An authorized person is an individual who is accessing their own personal tax. Personal Property Taxes are billed once a year with a December 5 th due date. Personal Property taxes are billed annually with a due date of December 5 th.

Vehicle License Tax Antique. Virginia Tax Individual Online Account Application. Tax Rate per 100 of assessed value Albemarle County 434 296-5856.

Use the map below to find your city or countys website to look up rates due dates. To visit the site register your alarm or make a payment visit Cry Wolf. 10 Homes Make an Outdoor Connection.

Tax Abatement In Richmond Virginia Significant Properties In Richmond Virginia

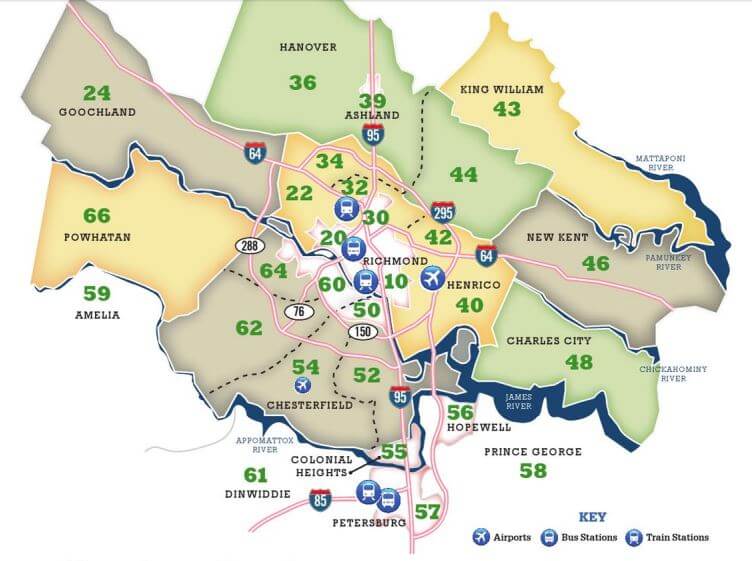

Guide To Richmond Area Mls Real Estate Zones Mr Williamsburg

Richmond Va Metro Area June 2021 Real Estate Market Update In 2021 Real Estate Marketing Real Estate First Home Buyer

5 Banbury Rd Richmond Va 23221 Realtor Com

2615 E Clay St Richmond Va 23223 Realtor Com

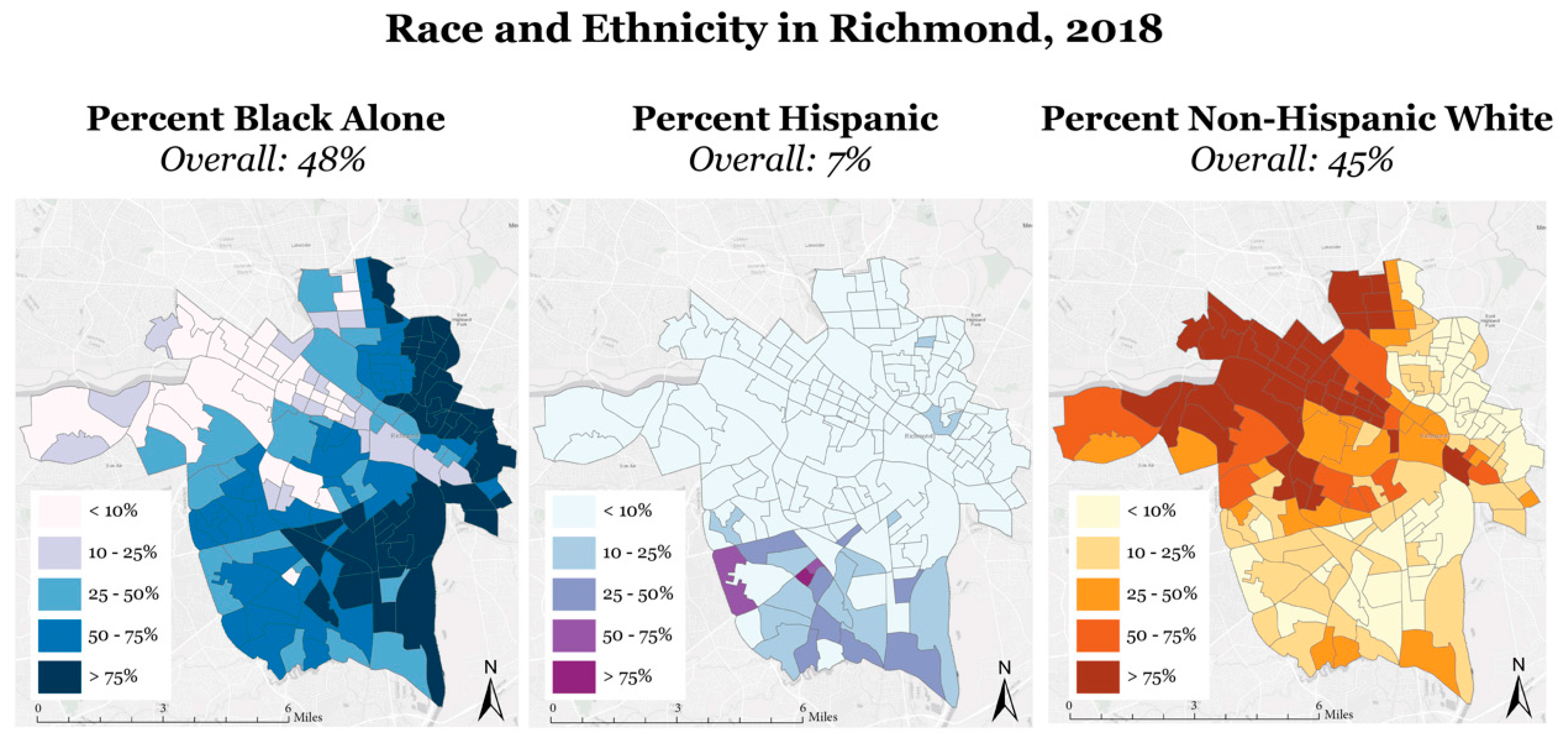

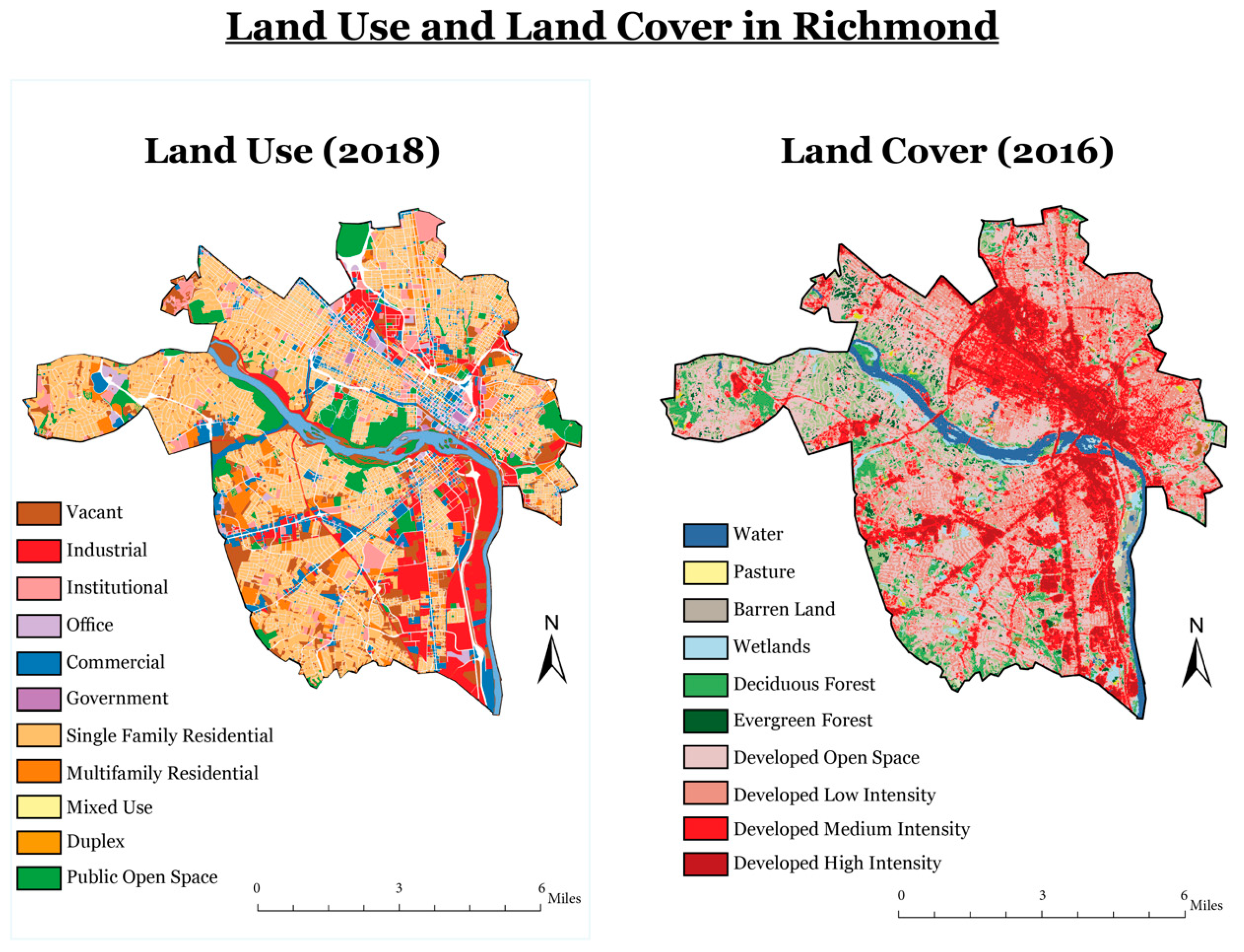

Sustainability Free Full Text Thermal Inequity In Richmond Va The Effect Of An Unjust Evolution Of The Urban Landscape On Urban Heat Islands Html

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

11 Things To Know Before Moving To Richmond Va

8719 Lakefront Dr Richmond Va 23294 Realtor Com

Formerly Redlined Areas Of Richmond Are Going Green Chesapeake Bay Foundation

The Ultimate Richmond Relocation Guide

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tax Exempt Bond Program Richmond Redevelopment Housing Authority

Sustainability Free Full Text Thermal Inequity In Richmond Va The Effect Of An Unjust Evolution Of The Urban Landscape On Urban Heat Islands Html

5505 Dendron Dr Richmond Va 23223 Realtor Com

Greater Richmond Population Increases By 200 New Residents Each Week Greater Richmond Partnership Virginia Usa

Public Housing In Richmond Virginia Richmond Cycling Corps